Media reported 丨 "iTIC" announces "China's Top 30 Insurance Technological Innovation Enterprises": VHS tops the list

In the fall of 2019, at the IFENXI TECHNOLOGY INNOVATION CONFERENCE,, the first domestic research media in the new economy field "iTIC" announced the 2019 "Top 30 Insurance Technology Innovation Enterprises in China" list. Breakthroughs and breakthroughs in insurance technology. As a representative of the top companies in the vertical field of insurance technology, VHS has joined the list with companies such as Ant Insurance, China Merchants Renhe, Weibo, Taikang Online and other companies. Assess indicators and analyze future trends in health insurance.

iTIC believes that in 2019, "insurance technology" with the digitalization of the insurance industry as its core can officially replace "Internet insurance" mainly based on channel innovation and become the mainstream trend in the industry. In order to convey this new trend, iTIC combined three years of insight into the insurance industry and several months of in-depth research and judgment, and officially released the "2019 iTIC · Top 30 Insurance Technology Innovation Enterprises in China" list.

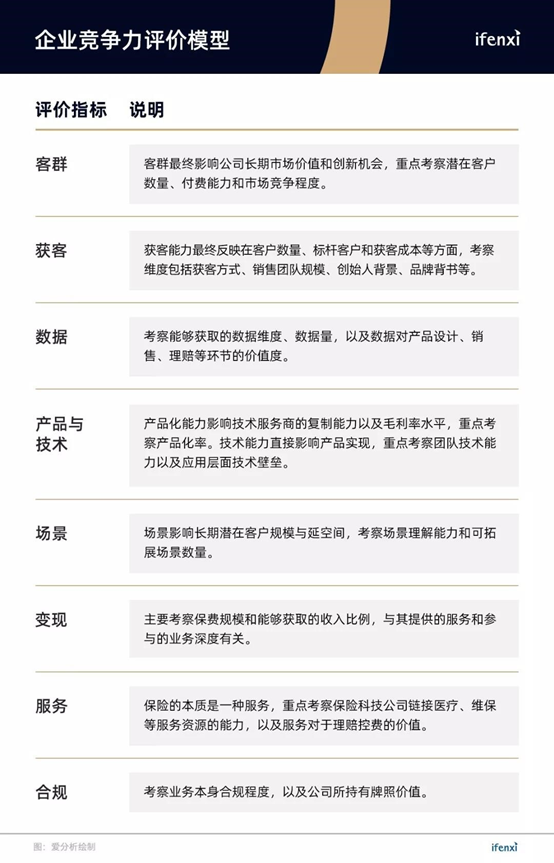

The 30 companies selected in this list are divided into five categories: digital ecology, insurance companies, brokers, smart marketing, smart claims and insurance big data. Business and operating conditions, as well as the future market prospects of the track and industry ceiling, combined with iTIC's evaluation model, determined the company's competitiveness in the segmented track and the entire insurance technology industry. The companies with the highest competitiveness scores in the market segment and the entire insurtech market will be shortlisted.

"Insurance big data" as an infrastructure still has a long way to go. Such companies must not only provide data analysis services to the industry, but also provide corresponding solutions. The three companies included in this list have a long way to go. VHS is one of the three companies on the list, and was invited to give a speech at the conference with the theme of "New Ecology of Health Insurance Risk Control Intelligence", introducing the practical application of efficient data service solutions for the insurance industry.

The article also mentioned that for health insurance, one of the mainstream insurance types, it is not easy to gain a foothold in the anti-fraud field. Anti-fraud investments generate the greatest returns and demand for insurance companies. 10-20% of payouts are related to fraud and leakage. If the payouts can be effectively controlled, it means that the industry-wide ROE has increased significantly. Because of the interpretability of insurance refusal claims, it not only requires data acquisition and analysis capabilities, but also involves a strong understanding of insurance scenarios in order to achieve better results in actual business. Once the business barriers are established, with the accumulated claims data and continuously optimized rules and models, the anti-fraud effect will become better and better, and it will be difficult to replace similar competing products. In the next 3-5 years, with the accumulation of claims, the pattern of health insurance will gradually become clear. Overseas, health insurance giant United Health has achieved remarkable results in rectifying the reasonable compensation ecology and reshaping the claims value chain.

Original link: http://ifenxi.com/archives/6277